No matter what stage your business is in, acquiring and attracting new customers is always important. After all, a regular cycle of incoming customers allows you to expand your reach, provide more services, and innovate with new products. Although some customers may arrive at your business organically, a majority are acquired through strategy and marketing.

Previously, we’ve discussed how to set up your foundation to improve your company’s customer acquisition strategy. Now you need to understand the cost associated with carrying out the tactics in this strategy to help you determine your true customer acquisition cost.

In this blog, we’ll help you understand what customer acquisition cost is and how it can impact your bottom line. You’ll also learn how to calculate this cost so that you have an accurate estimate at every stage in your business journey. We’ll look at the following:

- What is Customer Acquisition Cost?

- Why is Knowing Your Customer Acquisition Cost Important?

- How to Calculate Customer Acquisition Cost

- Defining Your “Customer Lifetime Value”

- Tips for Reducing Customer Acquisition Cost

What is Customer Acquisition Cost?

By definition, customer acquisition cost (CAC) is a metric that shows how much it costs in marketing and sales efforts to win a new customer during a set period of time. Hubspot describes the CAC as the cost of customer conversion.

If you’re not familiar with customer acquisition costs, it’s time to tune in. More likely than not, your company and team members are spending significant time, money, and resources to acquire new customers. Whether you’ve considered it or not, each new customer comes with a price.

That’s not to say the effort to secure and attract new customers isn’t worth it. In fact, your team should strive to add more customers regularly. Yet many marketing and business experts agree that out of control customer acquisition costs can truly ruin the health of your business in the long run. On the flip side, customer acquisition costs with a positive ROI will ensure your business succeeds for many years to come.

Why is Knowing Your Customer Acquisition Cost Important?

Business owners can use a calculated customer acquisition cost to determine the success of elements such as:

- Sales conversations

- Advertising and display ads

- Inbound marketing tactics

- Email marketing and automation

- Discounts, coupons, and incentives

This metric becomes especially important as your business expands. When your CAC is out of control, it affects the profitability of your business and how you will be able to operate in the coming years.

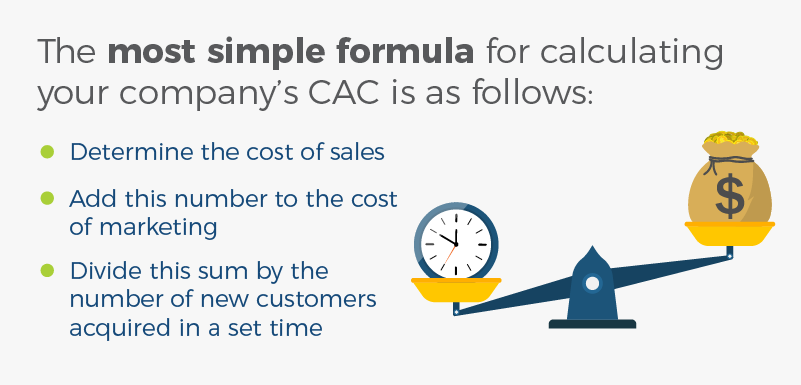

How to Calculate Customer Acquisition Cost

When it comes to calculating customer acquisition costs accurately, there’s a great deal of information out there. In general, you will need to determine a few important numbers before you can establish a set formula. These metrics include:

- How much you spend on expenses (marketing and sales efforts)

- A set time frame for when the money was spent (for example, the first quarter)

- How many new customers you acquired in that time

Marketing guru Neil Patel astutely points out that this calculation is helpful to business owners, but it may also be critical for investors. This is because investors, especially early-stage investors, are interested in a business’s current profitability and scalability.

The customer acquisition cost can provide an accurate picture of both of these qualifications.

Customer Acquisition Cost (CAC) Formula

When doing research, you may discover many different versions of the customer acquisition cost.

If you’re not sure where to pull these numbers from, you may need to look at costs associated with:

- Advertising spend

- Employee salaries

- Marketing campaign costs

- Inventory and maintenance

While this is not an exhaustive list, it’s a good starting point for calculating how much your company is spending on customer acquisition. You may need to calculate a few variations to determine the most accurate amount.

Additionally, if you’ve made significant investments during a specific time period (such as hiring several sales team members), this may inflate your final metric. To compensate for this, be sure to recalculate the CAC after periods of big investment.

Defining Your “Customer Lifetime Value”

While not exactly the same as the acquisition cost, the customer lifetime value (CLTV) is another important metric that can inform your plans for business growth. This metric shows how much total revenue a business can expect to receive from a single customer account over the course of that customer’s predicted lifespan.

The customer lifetime value can help business owners and marketing professionals quickly see which customer segments have the most value overall. Your specific business industry will probably have an effect on your customer lifetime value.

For instance, a retail or restaurant provider is going to see a higher frequency of purchases but at a lower amount. On the other hand, a SaaS company might have a very low purchase frequency but with a substantially higher purchase value.

Can You Improve CLTV?

If your team is frustrated by a relatively low customer lifetime value, remember that there are certain steps you can take to improve this number. To begin, you can ensure that your customer satisfaction rates remain high. Many companies with decreasing revenue have a low priority on customer satisfaction, which can negatively impact CLTV.

Additionally, you can place a strong focus on customer retention. The Harvard Business Review found that acquiring a new customer can be 5 to 25 times higher than retaining a current one. From both brand equity and financial standpoint, retention is critical.

Variables needed to calculate lifetime value (CLTV)

The simplest way to calculate the customer lifetime value is by subtracting the costs to acquire the customer from the amount of calculated revenue a customer brings. In slightly more complex versions of this formula, you may need to identify the following variables:

- The average purchase value

- The average purchase frequency rate

- The average customer lifespan

- The average costs of acquisition

Customer Acquisition Cost Varies By Industry.

Knowing your industry standards and benchmarks is crucial to developing a strong understanding of your customer acquisition cost. This is because customers are simply cheaper to acquire in some sectors rather than others.

For instance, the cost to acquire a new customer in the travel industry is relatively low (around $7), according to industry benchmarks. When you compare this to the cost of acquiring a new customer in the software field, which hovers just below $400, the difference looks staggering. These numbers alone, however, don’t paint the full picture.

As you consider your industry, make sure to do so within the bounds of customer lifetime value. Although some CAC ratios are extremely low, the customer is not investing in the product or service for an extended period of time. This fact alone greatly changes the customer acquisition costs in different industries.

Tips for Reducing Customer Acquisition Cost

In general, figuring out how to acquire new customers (and attracting the right kind of customers) takes a bit of trial and error. After you’ve tried a few different campaigns and strategies, it’s time to take a closer look at the customer acquisition cost formula.

If you’ve calculated your company’s customer acquisition cost and the ratio looks a little high, here are a few strategies for reducing it.

- Get even more specific with your target. You’ve probably heard it said before that if you’re trying to reach everyone, you’re actually reaching no one. This is especially true when it comes to effective marketing. If you’re missing the mark on your target audience, your customer acquisition cost could appear higher.

- Have a foolproof system for handling customer churn. Customer churn is what happens when you lose or turnover customers, which can happen for many reasons. Unfortunately, for each customer that is churned, your costs go up. Create a well-rounded customer support and feedback system to help reduce the rate of churn.

- Implement better testing strategies. Perhaps your CAC is high because your team hasn’t really figured out what works. To combat this, use A/B tests with things like emails, landing pages, calls to action, and ad copy. Once you have your results, use the highest converting version to reduce your acquisition costs.

- Define your Unique Selling Proposition (USP). Customer acquisition costs can be high when your team doesn’t have a great understanding of why your offer is unique. Your unique selling proposition defines why your product or service is different and attractive. When you can lead with this information in sales and marketing efforts, customers may be more inclined to buy.

Reduce Your CAC with Results-Focused Marketing

Striventa’s team of experts and consultants always keeps you and your business as the primary focus. Whether you’re struggling to acquire new customers or getting frustrated by ever-increasing costs, Striventa is here to help.

Striventa’s program helps you set up a customer acquisition strategy that will scale your business profitably. That means that no matter what your current pain point is, we’ve figured out the formula to help you rise above it.